AI-Powered Cyber Insurance for Small Businesses

Benefits of Smart Contracts for Small Businesses

22 February 2023

DAO Implementation Challenges Model In Companies

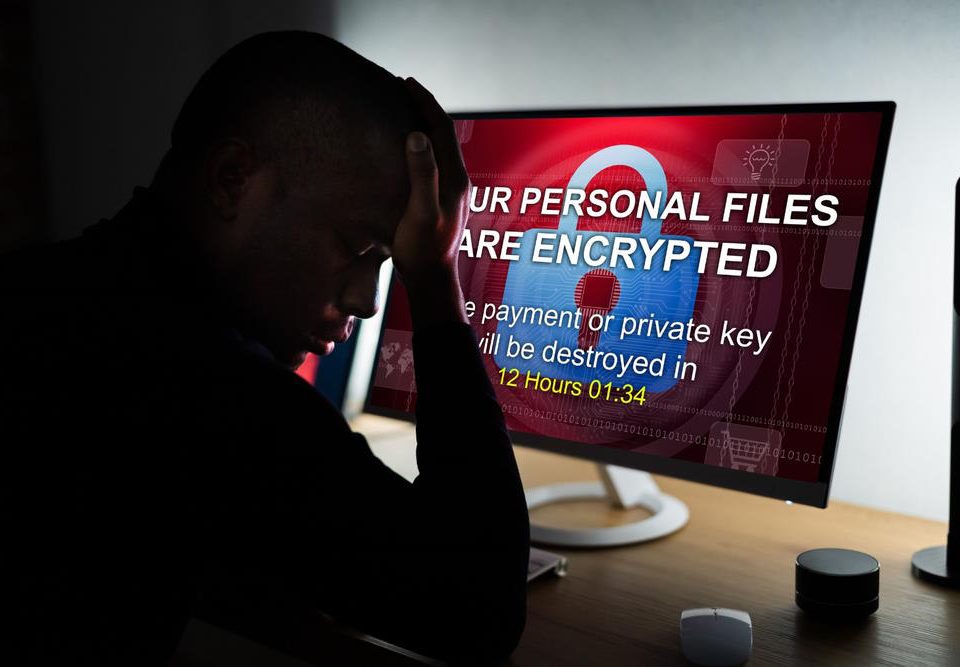

1 June 2023The threat of cyber attacks is a growing concern for small businesses in Canada and the USA, as these attacks can lead to significant financial losses, reputational damage, and legal liability. To address these risks, many small businesses are turning to cyber insurance as a way to mitigate their exposure and protect against potential losses. In recent years, there has been a growing trend toward AI-powered cyber insurance, which uses machine learning algorithms and other advanced technologies to automate the underwriting process, analyze risks, and expedite the claims process.

One of the main benefits of AI-powered cyber insurance for small businesses is the speed and efficiency of the underwriting process. Traditional underwriting can be slow and cumbersome, requiring businesses to fill out lengthy applications and provide extensive documentation. AI-powered underwriting, on the other hand, can quickly analyze data from a variety of sources to determine the level of risk and provide a customized policy quote within minutes.

Another benefit of AI-powered cyber insurance is the ability to customize policies based on the unique needs and risks of small businesses. With machine learning algorithms, insurers can more accurately predict the likelihood of a cyber attack and tailor coverage to address the specific risks faced by small businesses. This level of customization can help small businesses to better protect themselves against potential losses and reduce the financial impact of a cyber attack.

Finally, AI-powered cyber insurance can also expedite the claims process, allowing small businesses to quickly recover from a cyber attack and resume normal operations. By automating the claims process and using advanced technologies to analyze data, insurers can quickly assess the damage and provide funds to cover the costs of recovery. This can be especially important for small businesses that may not have the financial resources to absorb the costs of a cyber attack without insurance coverage.

Overall, AI-powered cyber insurance is an increasingly important tool for small businesses in Canada and the USA. By leveraging advanced technologies to automate the underwriting process, customize policies, and expedite claims, small businesses can better protect themselves against the risks of cyber attacks and ensure their long-term success.