CyberCover helps small businesses access cyber insurance through a simplified, compliance-aligned technology platform.

Decentralized Insurance

CyberCover Defi insurance is a decentralized financial institution set up on the Ethereum block chain, all the transactions are on crypto currency. BINS is the private token dedicated to the CyberCover Insurance risk bin. Bins are issued lateral to the premiums paid (freezed in beneficiary of the CyberCover Insurance Reserve in base coin and cold reserve in safe allocated nodes. Since any claim payment is settled through smart contract equal BINS freeze and same value of base coin release in beneficiary of damaged policy holed.

vs

Conventional Insurance

Conventional Insurance as created at early days, is a means for sharing, lowering financial risk. The risk by its nature, if it becomes certain, imposes financial and or corporal losses; the loss which is imposed on the policy holder or third parties. As the financial relations become more complicated and the number of participants become huge, the insurance structure becomes complicated, insurers face a huge number of concerns which lead to bureaucracy and high operational costs.

How It Works

Give us a brief overview of your business

See results of your website security

Use our tools to increase your cyber security

Compare, purchase and get insured instantly

Watch the Video

Why Cyber Cover

Built specifically for Canadian SMBs without dedicated IT teams

Simplifies cyber insurance onboarding and documentation

Designed for trade-based and service-oriented businesses

Supports broker-led and referral-based distribution models

Operates under a compliance-first framework

Cyber Facts

$

0

k

is the average cost of a cyber attack on a small business in 2023.

0

%

of all cyber attacks now aimed small businesses in the US.

0

%

of SMBs have implemented comprehensive cybersecurity programs in 2023.

0

%

of US businesses have experienced a cyber attack in the past year, as cyber threats continue to rise and become more sophisticated.

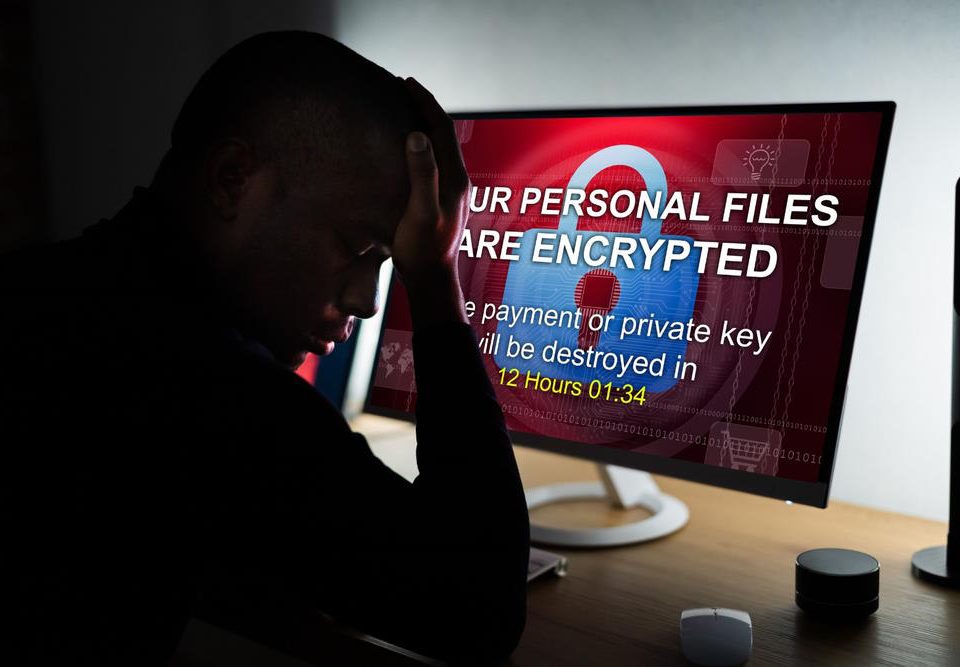

What is cyber insurance?

Cyber insurance, also known as cyber liability insurance or cyber risk insurance, is a type of insurance policy that helps organizations to mitigate the financial risk associated with a cyber-related security breach or similar event. A cyber insurance policy can offset the costs involved with recovering from a cyber attack, including expenses related to first-party damage as well as claims made by third parties.

Cyber insurance includes expenses related to first-party damage as well as claims made by third parties. Although there is no standard for underwriting these policies, the following are common reimbursable expenses:

First-party coverage refers to expenses that an organization incurs directly as a result of a cyber attack, such as the cost of data restoration and recovery, business interruption, and damage to computer systems or networks. First-party coverage can also include the cost of hiring a public relations firm to manage reputational damage or the cost of legal fees for notifying affected customers or regulatory authorities.

- Loss or Damage to Electronic Data – Covers the cost to replace or restore electronic data or programs damaged, destroyed or stolen in a data breach, whether the data belongs to your firm or someone else. Losses must result from a covered peril such as a hacker attack, a virus, or a denial of service attack. Policies may also cover the cost of hiring experts or consultants to help preserve or reconstruct data.

- Loss of Income and Extra Expenses – Covers income losses you suffer and extra expenses you incur to avoid or minimize a shutdown of your business after your computer system fails due a covered peril. Some policies, including the Hartford and Travelers policies cited above, cover dependent income losses. These are income losses you sustain when your network provider’s system has been breached.

- Cyber Extortion – Applies when a hacker breaks into your computer system and threatens to commit a nefarious act like damaging your data, introducing a virus, initiating a denial of service attack, or releasing confidential data unless you pay a specified sum. Coverage typically extends to any extortion payment you make and expenses you incur in responding to the demand.

- Notification Costs – Covers the cost of notifying parties (voluntarily or as required by law) affected by a data breach. May also cover the cost of providing credit monitoring services and establishing a call center.

- Damage to Your Reputation – Some policies cover costs you incur for marketing and public relations to protect your company’s reputation following a data breach. This coverage may be called Crisis Management.

Third-party liability coverage, on the other hand, covers claims made by third parties against an organization for damages arising from a cyber attack, such as lawsuits filed by customers or partners for breach of contract, negligence, or failure to protect sensitive data. Third-party coverage can also include the cost of regulatory fines and penalties or the cost of credit monitoring services for affected customers.

- Network Security and Privacy Liability – Covers claims against your firm for negligent acts, errors or omissions that result in a denial of service attack, unauthorized access, introduction of a virus, or other security breach of your computer system. Also covers claims alleging you failed to properly protect sensitive data stored on your computer system. The data may belong to customers, clients, employees or other parties.

- Electronic Media Liability – Electronic media liability insurance covers lawsuits against you for acts like libel, slander, defamation, copyright infringement, invasion of privacy or domain name infringement. Generally, these acts are covered only if they result from your publication of electronic data on the Internet.

- Regulatory Proceedings – Covers fines or penalties imposed on your firm by regulatory agencies that oversee data breach laws. Also covers the cost of hiring an attorney to assist in your response to a regulatory proceeding

Features

Smart Insurance underwriting

Smart insurance underwriting is a modern approach to the insurance process that leverages the latest advancements in artificial intelligence and machine learning to create a more efficient, faster, and less complex experience for customers. By using AI-enabled chatbots and interactive applications, insurers can automate many of the processes involved in underwriting policies, from data collection to risk assessment, making the insurance experience much more seamless and straightforward.

One of the main benefits of smart insurance underwriting is speed. In traditional underwriting processes, customers must fill out long forms and go through multiple rounds of back-and-forth with insurance agents to get a quote. With AI-enabled chatbots, however, the process is much faster and can be completed in a matter of minutes. Chatbots can ask targeted questions and collect the necessary data to assess risk, and provide quotes almost instantly.

Another benefit of smart insurance underwriting is its ease and simplicity. Interactive applications and chatbots can guide customers through the insurance process step-by-step, making it easier for them to understand their options and choose the right policy for their needs. With AI-enabled chatbots, customers can get answers to their questions at any time of day, without having to wait for an agent to be available.

Smart insurance underwriting also allows insurers to reduce costs by automating many of the tasks involved in underwriting. By using AI to analyze data and assess risk, insurers can reduce the need for human intervention and free up agents to focus on more complex tasks that require personal attention. This not only reduces costs for the insurer, but can also lead to lower premiums for customers.

Overall, smart insurance underwriting is a game-changer for the insurance industry, enabling insurers to provide faster, easier, and less complex insurance experiences for customers. With the help of AI-enabled chatbots and interactive applications, insurers can streamline the underwriting process, reduce costs, and ultimately provide better service to their customers.

Cyber Security Risk Report

We perform several web security scans on your website to calculate your Cyber Risk Index, free scan includes:

- Website and Web Server Security Analysis

- GDPR compliance Analysis

- Cookies Security Analysis

- HTTP Headers Security Analysis

Compare and purchase

Compare different insurance coverages and prices to find the insurance that’s the best fit for you.

FAQs

Cyber insurance, also known as cyber liability insurance or cyber risk insurance, is a type of insurance policy that helps organizations to mitigate the financial risk associated with a cyber-related security breach or similar event. A cyber insurance policy can offset the costs involved with recovering from a cyber attack, including expenses related to first-party damage as well as claims made by third parties.

In order to qualify for coverage, the small and medium-size business must not have revenue that exceeds $20 million. This figure is based on annual revenue.

The maximum policy limit for a cyber insurance policy will vary depending on the insurer and the specific policy. Most policies will have a limit on the total amount of coverage that can be provided for first-party and third-party expenses, and this limit may be further broken down into sub-limits for specific types of expenses. It’s important to carefully review the policy documents and understand the coverage limits before purchasing a policy.

Many insurance providers offer customized cyber insurance policies to meet the specific needs of individual businesses. Customized policies may include additional coverage options or higher coverage limits for certain types of expenses, depending on the needs of the business. It’s important to work with an experienced insurance provider to determine the coverage that is right for your business.

In case you got attacked by hackers, our online claim procedure can be used right from your personalized dashboard to process the claim in a very user-friendly process.

Blog

DAO Implementation Challenges Model In Companies

1 June 2023Decentralized autonomous organizations (DAOs) are blockchain-based organizations fed by a peer-to-peer (P2P) network of contributors. Their management is decentralized without top executive teams and built on […]

AI-Powered Cyber Insurance for Small Businesses

1 March 2023The threat of cyber attacks is a growing concern for small businesses in Canada and the USA, as these attacks can lead to significant financial losses, […]Benefits of Smart Contracts for Small Businesses

22 February 2023Smart contracts are digital agreements that automatically execute when specific conditions are met. They are designed to be transparent, secure, and efficient, and can be used […]Cyber Attacks on Small Businesses in Canada and the USA

16 February 2023Cyber attacks can be devastating for small businesses in Canada and the USA, leading to significant financial losses, reputational damage, and legal liability. Small businesses are […]