Who we are?

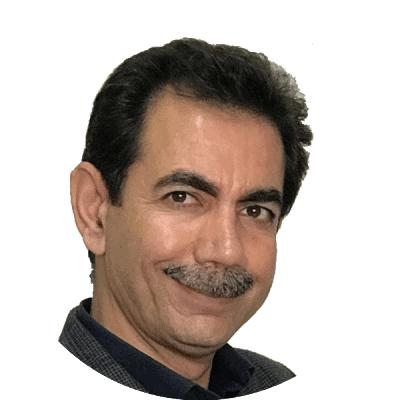

Mohammad Ali Sarlak

CEO

I’m a seasoned expert with extensive managerial experience and a Ph.D. in management. I published multiple books and articles in the USA and Canada with a focus on the management of innovative and agile organizations. The majority of my career was related to new management techniques in the financial industry and particularly new products in the insurance industry.

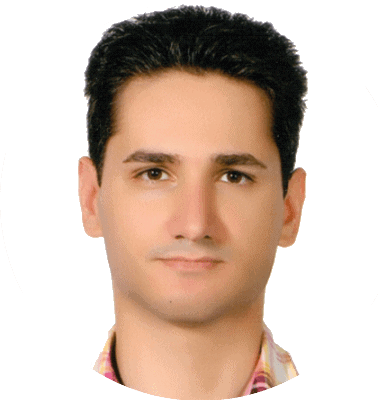

Mehdi Mottaghi

CMO

I’m a creative and enthusiastic individual with multi-attribute negotiation proficiency, which can provide our clients with full-featured risk analysis services as a part of our marketing strategy. I have a proven ability to introduce clients with our intelligent underwriting solutions and lead our professional technical team to design adequate cyber cover solutions for potential fast-growing cyber risks.

Farzad Aflaki

CTO

I’m a technology officer with over ten years of extensive engineering management, development, and implementation experience, transforming business vision to technology solutions. Strengths in project execution and end-to-end Software Design Life Cycle (SDLC), including planning, designing for commercialization, agile development, implementation, and maintenance.

Azin Mohajerani

VP OF SALES

I’ve started my career from the bottom of the organisation chart and moved to the top, I learned sales skills through learning by doing combined with multiple sales training by top professional education providers. I am a creative, self motivate and always focused on my job topics, I love to get challenged by complex sales deals and business development projects particularly for new line of products.

Hooman Setoodeh

VP OF PRODUCT

I am a VP of product for an innovative online cyber insurance company offering cyber insurance for SMEs. Owned the consumer subscription business and enterprise offerings. Established clear product direction and recruited top talent product and design team members, guided next-generation innovations, and rolled-out disciplined processes across the product lifecycle.

How we start our journey?

2017 The Problem Identified

The founding team identified a growing gap between increasing cyber risks and the limited accessibility of cyber insurance for small and medium-sized businesses. Early research highlighted that existing insurance products were largely designed for enterprise clients and poorly aligned with the operational realities of SMBs, particularly trade-based and service-oriented businesses.

2018Cyber Cover Founded

CyberCover was formally established to explore technology-driven approaches to simplifying cyber risk assessment and improving access to insurance solutions for small businesses. Initial concept development and early market research were undertaken during this period.

2019Seed Money Raised

The company secured seed-stage funding to support product concept validation, early technical development, and foundational research into cyber risk modeling and insurance workflows.

2020Raised 2nd Round

InvestmentAn additional round of investment was raised to advance platform development, expand technical capabilities, and prepare for broader market testing. This phase focused on building a scalable product foundation.

2021MVP Developed

CyberCover completed development of its minimum viable product (MVP) and incorporated in British Columbia as part of its North American market entry strategy. Initial regulatory research and market assessment for Canada began during this stage.

2022Application Released

The first application version was released, enabling controlled testing of onboarding workflows, risk intake processes, and user experience. Feedback from early users informed iterative improvements.

2023Expanding into the North American Market

CyberCover expanded its operational focus to Canada, establishing an Ontario branch and initiating pilot commercialization activities. Leadership presence was established in Canada, and extensive in-person market engagement was conducted to validate customer needs, pricing assumptions, and distribution strategy.

2024Regulatory Alignment and Market Deepening in Canada

CyberCover strengthened its Canadian operations through increased leadership presence and regulatory focus. The Chief Executive Officer relocated to Canada to lead regulatory mapping, legal structuring, and stakeholder engagement. During this period, the company refined its partner-led distribution model, continued in-person market research across Ontario, and focused product development on localization and compliance alignment.

2025Platform Readiness and Controlled Growth

CyberCover entered a preparation phase focused on operational readiness and sustainable growth. Key activities included refining the platform based on pilot feedback, strengthening relationships with licensed partners, and advancing internal governance processes. These efforts positioned the company for controlled, compliance-first expansion following pilot validation.

Our Clients

Contact Us

Do you need help or support?